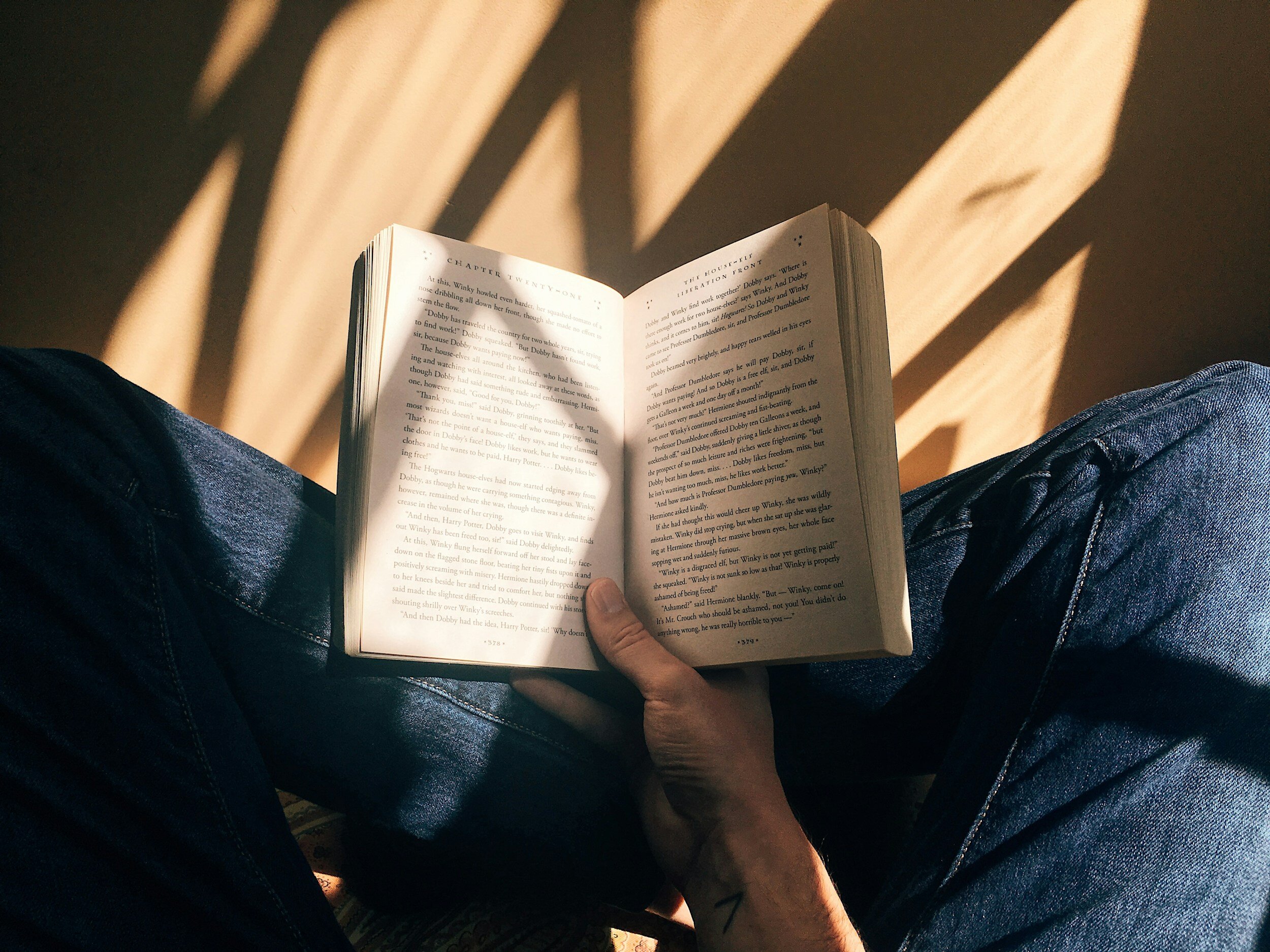

Leadership and the Habit of Reading

The concept that "leaders are readers" encapsulates a foundational truth about effective leadership: the continuous pursuit of knowledge through reading serves as a cornerstone for successful leadership. Leaders who place a premium on reading gain invaluable insights, remain abreast of industry trends, and sharpen their intellectual acuity to confront intricate challenges.

Leadership in Times of Crisis: Lessons from History

Leadership in a time of crisis requires more than just managerial skills; it demands a deep understanding of human psychology, the ability to instill confidence, and a commitment to shared values.